VTI has an expense ratio of only 0.07%, a mere $7 for each $10000 invested.

According to the output, a portfolio expense ratio of 0.06% per year is "5-6

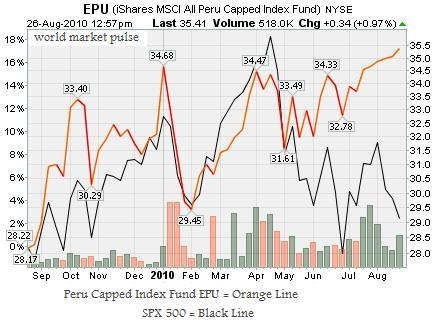

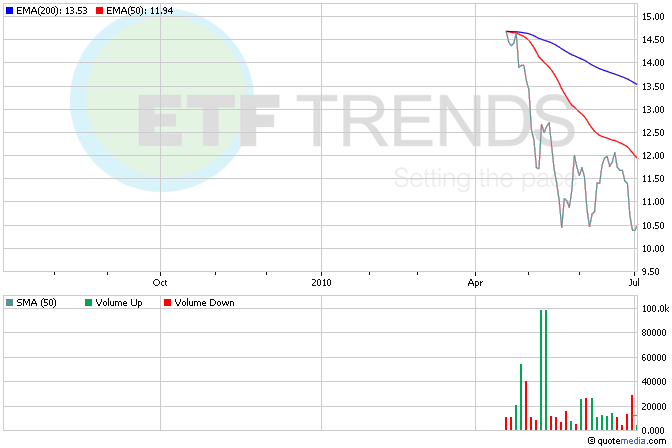

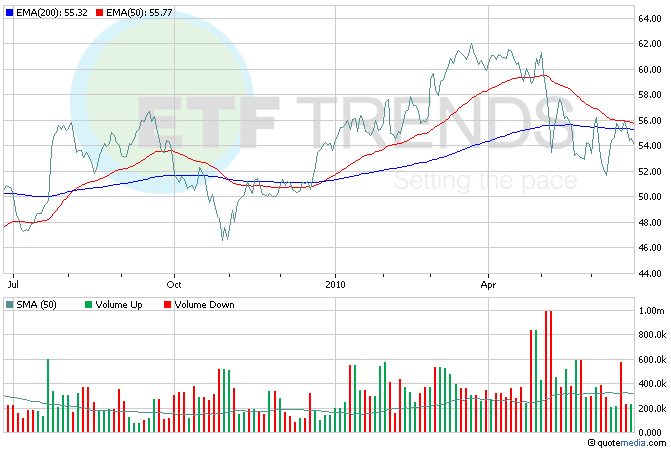

Expense Ratio: 0.63% The Above graph shows that EPU is following an inverse

Here, ETFs almost always win: The average expense ratio for all ETFs in the

fund fees (as measured by Total Expense Ratio) among 18 western nations.

has gathered $28 million in assets and charges a 0.95% expense ratio.

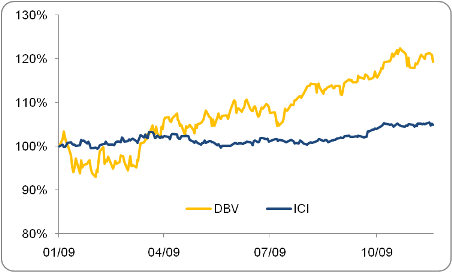

However, DBV has a higher expense ratio, coming in at 0.75% compared to ICI

The minimum investment is $100000, but the expense ratio is only 8 basis

2) Over $100 million of total assets; 3) An expense ratio no

considering the slim expense ratio differences we're talking about.

COPX has an expense ratio of 0.65%.

PCY, on the other hand, has 55 holdings and a o.50% expense ratio.

total assets of $16.9 billion, 513 holdings, and expense ratio of .12%.

assets of $1.2 billion, 348 holdings, and an expense ratio of 0.60%.

should note that both GLD and SLV ETF's deduct annual expense ratio's of

The top 10 stocks make up 46% of the portfolio and the expense ratio is a

It has a 0.60% expense ratio.

The expense ratio is 0.35%.

If you invest at Vanguard, the total expense ratio for this portfolio would

A low expense ratio (0.41 per cent) also helped.

No comments:

Post a Comment